This paper examines critical aspects of international banking law, focusing on the banker-customer relationship, defenses in SWIFT fraud cases, and the structure of syndicated loan agreements. The study provides an in-depth analysis of... more

Empirical evidence suggests that even those firms presumably most in need of monitoringintensive financing (young, small, and innovative firms) have a multitude of bank lenders, where one may be special in the sense of relationship... more

William Lang, and Jacob Paroush for their helpful comments. The authors gratefully acknowledge the support of Cathy Lemieux, and research assistance of Gulcin Afres, Sreedhar Bharath, Danny Chang, Yonca Ertimur, Gijoon Hong, Victoria... more

Bank credit has evolved from the traditional relationship banking model to an originateto-distribute model. We show that the borrowers whose loans are sold in the secondary market underperform their peers by about 9% per year... more

Following Miles and Snow's Business Strategy (BS) topology, we find that banks impose relatively higher loan spreads for the firms that follow an Innovation-Oriented Business Strategy (IOBS). We further document that IOBS is positively... more

Upper Devonian continental and subaqueous sedimentary rocks and bimodal volcanic rocks of the Boyd Volcanic Complex of the south coast of New South Wales were deposited in a rapidly subsiding, 330°-trending, transtensional basin.... more

We use the near-collapse of the Norwegian banking system during the period 1988-91 to measure the impact of bank distress announcements on the stock prices of firms maintaining a relationship with a distressed bank. We find that although... more

Zenios and three anonymous referees made comments that greatly helped to improve this chapter. All remaining errors and omissions are our own.

We highlight the implications of combining underwriting services and lending for the choice of underwriters and for competition in the underwriting business. We show that cross-selling can increase underwriters' incentives, and we explain... more

The purpose of this study was to examine the role of relational commitment on customer behavioural intentions in Kenya's banking sector. The basic research question examined was whether or not customer commitment in service... more

This study examines the role of information asymmetry in the choice between rights issue and private equity placement from an important emerging market-India. In the post IPO scenario, Indian firms issue equity mainly through private... more

This paper analyses the effects that public credit guarantees have on SME business activity and investment. We focus the study on the main regional mutual guarantee institution in the Spanish Region of Madrid, covering two distinct stages... more

focuses on high quality research in economics and business, with special attention to a multidisciplinary approach. In the working papers series the U.S.E. Research Institute publishes preliminary results of ongoing research for early... more

This paper studies the relation between average growth and growth volatility. To do so a two period model is built which focuses on how firms choose their debt portfolio maturity. Due to imperfect enforceability problems, we show that... more

We derive empirical implications from a theoretical model of bank–borrower relationships. The interest‐rate mark‐ups of banks are predicted to follow a life‐cycle pattern over the age of the borrowing firms. Because of endogenous bank... more

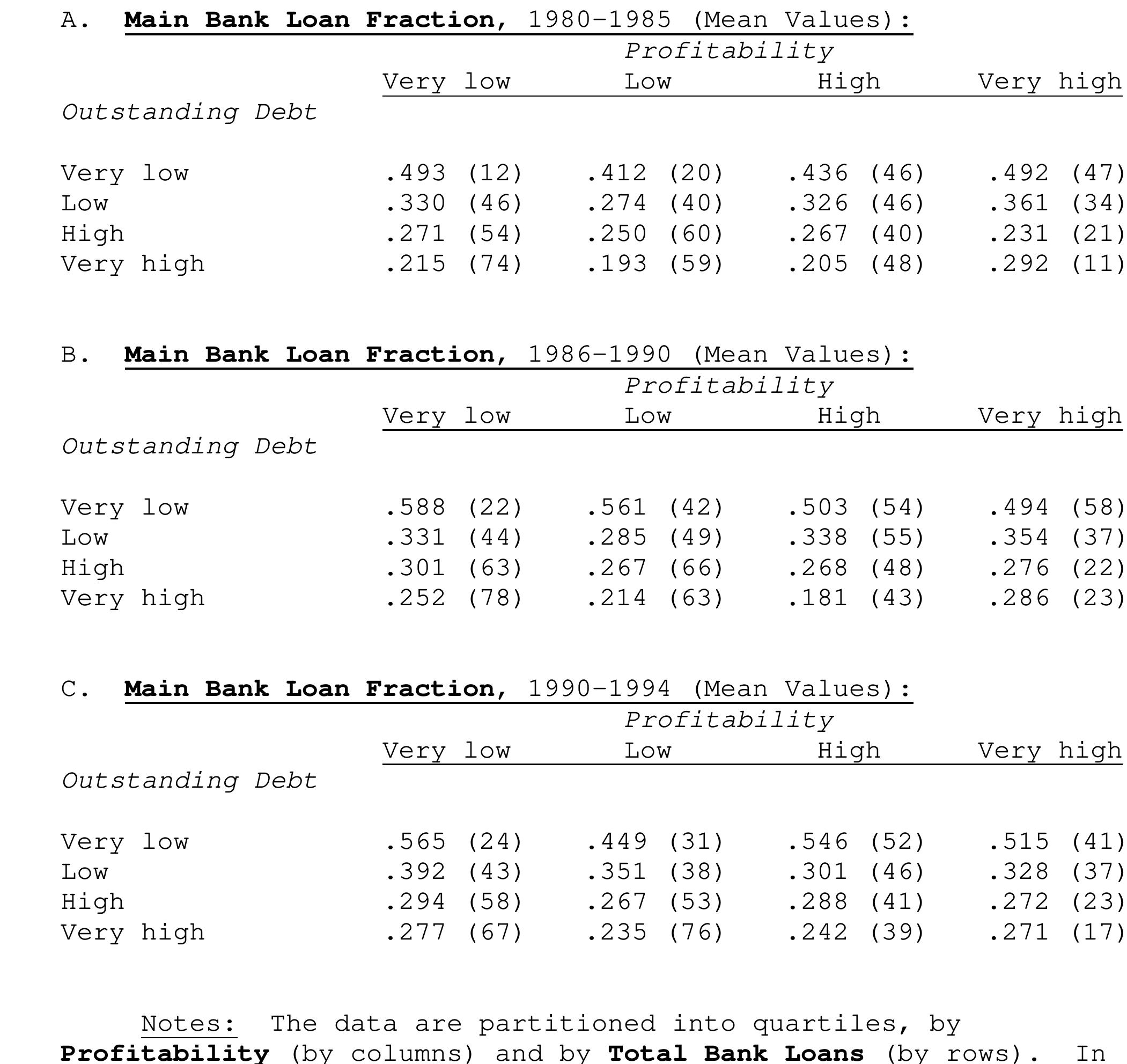

The Japanese "main bank system" figures prominently in the recent literature on "relationship banking." By most accounts, the main bank epitomizes relationship finance: traditionally, every large Japanese firm had one, and that bank... more

, "Evolving credit markets and business cycle dynamics" Conference (European University Institute). Luigi Guiso also thanks the EEC and MURST for financial support. Luigi Zingales also thanks the Center for Security Prices and the Stigler... more

We show that firms with illiquid stock pay higher syndicated loan spreads. This result is invariant to multiple measurements of stock illiquidity, and is robust to a wide set of cross-sectional loan and firm features, firm and year fixed... more

Post crisis, bank loan spreads increased and have remained elevated despite central bank actions, low LIBOR rates and observed Treasury yields. Using large syndicated loan dataset, this paper estimates that a one percentage point to GDP... more

Post crisis, bank loan spreads increased and have remained elevated despite central bank actions, low LIBOR rates and observed Treasury yields. Using large syndicated loan dataset, this paper estimates that a one percentage point to GDP... more

This paper examines the relation between the corporate life cycle and lending spreads. Using a sample of 20,307 firm-loan observations spanning 5,076 publicly traded U.S. firms, we find that lending spreads follow a U-shape pattern across... more

Examining bank behavior around Federal Reserve stress tests, we find that stress test banks increase capital ratios at the starting point for annual stress testing significantly more than nonstress test banks. These trends are completely... more

This paper highlights the importance of bank-based finance for the innovation activity of UK firms. It identifies both theoretically and empirically how bank shocks affect firms' innovation. We develop a theoretical model, and test its... more

Purpose: Commitment in underpinning long‐term business relationships is well established. Limited research exists involving relationships between SMEs and banks. The paper presents an instrument to assess such relationships and is... more

Is there a relationship between bank monitoring models and the level of shadow economy? This paper develops a model of optimal lending technology to study the relationship between local underground economic activity and banks' lending... more

� The views expressed here are those of the authors and do not necessarily reflect those of the Bank of England

In this paper we quantify the differences between market and regulatory assessments of bank portfolio risk, and thereby demonstrate that larger differences significantly reduce corporate lending rates. Specifically, to entice borrowers,... more

Financial theory indicates that low interest rates hamper credit risk and profitability, two interrelated components of banks' balance sheets. Using a simultaneous equations framework, we investigate the effects of euro area monetary... more

Financial theory indicates that low interest rates hamper credit risk and profitability, two interrelated components of banks' balance sheets. Using a simultaneous equations framework, we investigate the effects of euro area monetary... more

We propose that relationship bankers are able to benefit their clients even after they indicate distress. Relationship bankers continually learn about their clients to reduce the asymmetric information problem, reduce adverse selection... more

A substantial literature has investigated the role of relationship lending in shielding borrowers from idiosyncratic shocks. Much less is known about how lending relationships and bank-specific characteristics affect the functioning of... more

We study price formation on interbank markets. We develop a theoretical model by extending existing theories to explain observed facts that cannot be explained by these models. In particular, in our model we do not assume that banks use... more

This paper reviews the background and current status of relationship banking in Japan. First, the composition and share of the banking sector in the total financial market are discussed along with the measures taken in the banking sector... more

L'Algérie ne peut espérer diversifier son économie tant qu'elle sous-estimera l'essor d'un système bancaire moderne privé, capable de jouer un rôle crucial dans le financement de l'activité économique et industrielle. C'est un préalable... more

This paper looks at the evolution of business banking relationships regarding the stability of the volume of trade between corporate clients and their banks. Ten cases of dyadic relationships were studied. For each relationship, we looked... more

This paper explains the recent decline in bank asset quality using the notion of information reusability. Banks are viewed as information processors; they exist because of their advantage in extracting the surplus associated with the... more

The presence of venture capital in the ownership structure of U.S. firms going public has been associated with both improved long-term performance and lower underpricing at the time of the IPOs. In Japan, we find the long-run performance... more

Current practices of financial institutions in the US lack capability to differentiate-and accordingly underwrite-commercial energy efficiency investments from 'normal' real estate investments. This deficiency in underwriting on projects... more

Current practices of financial institutions in the US lack capability to differentiate-and accordingly underwrite-commercial energy efficiency investments from 'normal' real estate investments. This deficiency in underwriting on projects... more

This study analyzes the effect of information asymmetry on corporate cash holdings. Using various measures of information asymmetry, this study shows that companies that operate in environments with higher information asymmetry have... more

The partial takedown phenomenon associated with bank loan commitments is examined in a dynamic context in which banks adjust commitment prices to client takedown behavior. The optimal takedown is an increasing function of client riskiness... more

We derive empirical implications from a stylized theoretical model of bankborrower relationships. Banks' interest rate markups are predicted to follow a life-cycle pattern over the borrowing firms' age. Due to endogenous bank monitoring... more

We investigate whether banks price drought risk in the interest rates charged to corporate borrowers. The results show that banks do charge drought‐affected borrowers higher loan spreads. The spread increase is most pronounced among food... more

We also thank Aleksandra Baros for valuable research assistance. Finally, we are grateful to Huasheng Gao for sharing governance data and to John Asker, Joan Farre-Mensa, and Alexander Ljungqvist for sharing the venture capital... more

Rising internatio)nal bank finanicinig to developing lending has become less "indiscriminate" and more coulitries hIas fLueled a debate on the behavior of these responsive to host conditionis over time. Responsiveness claimils. The... more

This paper analyses the development of bank long-term funding over the last 13 years in Europe, US and Japan. We collected information on banks' long-term debt issuance for the years 2000-2012. Our sample includes all bond issues by banks... more

This is a PDF file of an article that has undergone enhancements after acceptance, such as the addition of a cover page and metadata, and formatting for readability, but it is not yet the definitive version of record. This version will... more

The paper examines the causal impact of bank-firm interlocking directorates on a firm’s access to credit. We exploit matched bank-firm panel data containing information on the firms' loans and on the governing bodies of both the... more

Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Zwecken und zum Privatgebrauch gespeichert und kopiert werden. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle Zwecke vervielfältigen, öffentlich ausstellen,... more

![Sources: Nikkei QUICK joho, K.K., NEEDS (Tokyo, Nikkei QUICK oho, as updated); Nikkei QUICK joho, K.K., QUICK (Tokyo, Nikkei QUICK oho, as updated); Nihon shoken keizai kenkyu jo, ed., Kabushiki toshi hueki ritsu [Rates of Return on Common Stocks] (Tokyo: Nihon shoken sizai kenkyu jo, updated); Toyo keizai, ed., Kigyo keiretsu soran Firm Keiretsu Overview] (Tokyo: Toyo keizai, as updated). Table 1: Selected Summary Statistics (Continued)](https://figures.academia-assets.com/112888308/table_002.jpg)