Fi in na an nz za as s

Este paper muestra el pronóstico de la tasa de cambio entre el peso colombiano y el dólar estadounidense (en adelante dólar) desde Diciembre del 2019 hasta Diciembre del 2020, basado en un modelo VEC (Vector Error Correction) a partir de... more

The future of e-money is crypocurrencies, it is the decentralize digital and virtual currency that is secured by cryptography. It has become increasingly popular in recent years attracting the attention of the individual, investor, media,... more

This study examined the major factors that drive changes in yam consumption patterns across income groups, seasons and urban centers in Ghana to inform food policy formulation. The study, among other things, sought to provide evidence on... more

Using panel data from 144 countries, this study constructed an inclusive financial evaluation index and depicted the inclusive finance development worldwide under digital empowerment through classification. It reviewed the spatial effect... more

The ARIMA (Autoregressive Integrated Moving Average) was applied to the series of SPI -1. The results of the evaluation of the model showed good agreement between observations and forecasts , as was also confirmed by the values of some... more

European, national governments and regional authorities, in recent times, are actively encouraging technology transfer from universities to industries as a fulfilment of the well embraced "third mission" of universities. To... more

Econometric estimation using simulation techniques, such as the efficient method of moments, may be time consuming. The use of ordinary matrix-programming languages such as GAUSS, MATLAB, Ox, or S-PLUS will often cause extra delays. For... more

Abdullah ÖZDEMİR ii , Alican BİLGEN iii Öz Döviz kuru; bir ülkenin para biriminin başka bir para birimi cinsinden fiyatı olarak tanımlanmaktadır. Döviz kuru dalgalanması veya istikrarı ise ekonomik büyümenin kuantumunu ve yönünü... more

Energy markets have been undergoing dramatic transformations in recent decades. Deregulation in the electricity and gas markets has forced a whole new world of trading and risk management. Risk managers, scholars, and experts of energy... more

Several phenomena are available representing market activity: volumes, number of trades, durations between trades or quotes, volatility -however measured -all share the feature to be represented as positive valued time series. When... more

Stock prices are impacted by an array of different factors that can affect movement of prices daily. It is essential to investors and traders to understand the volatility of the nature of the stock, before investing in it. In today’s... more

Bu calismanin amaci, ekonomiyi etkileyen makro degiskenlerden olan enflasyon, faiz oranlari ve para arzinin doviz kuru uzerinde etkili olup olmadiginin arastirilmasidir. Bu amac dogrultusunda, soz konusu degiskenlerin doviz kuru... more

Among various kinds of options we can found at the market, some are traded at organized exchanges and therefore are quite liquid, while others are traded only between particular parties. Whereas there is no need to look for a model to... more

This paper makes an attempt to examine the financial integration between emerging countries and developed countries. Stock market data for six countries USA, CANADA, UK, India, Malaysia and Singapore have been used for the purpose of the... more

This paper makes an attempt to examine the financial integration between emerging countries and developed countries. Stock market data for six countries USA, CANADA, UK, India, Malaysia and Singapore have been used for the purpose of the... more

A Bayesian High-Frequency Estimator of the Multivariate Covariance of Noisy and Asynchronous Returns

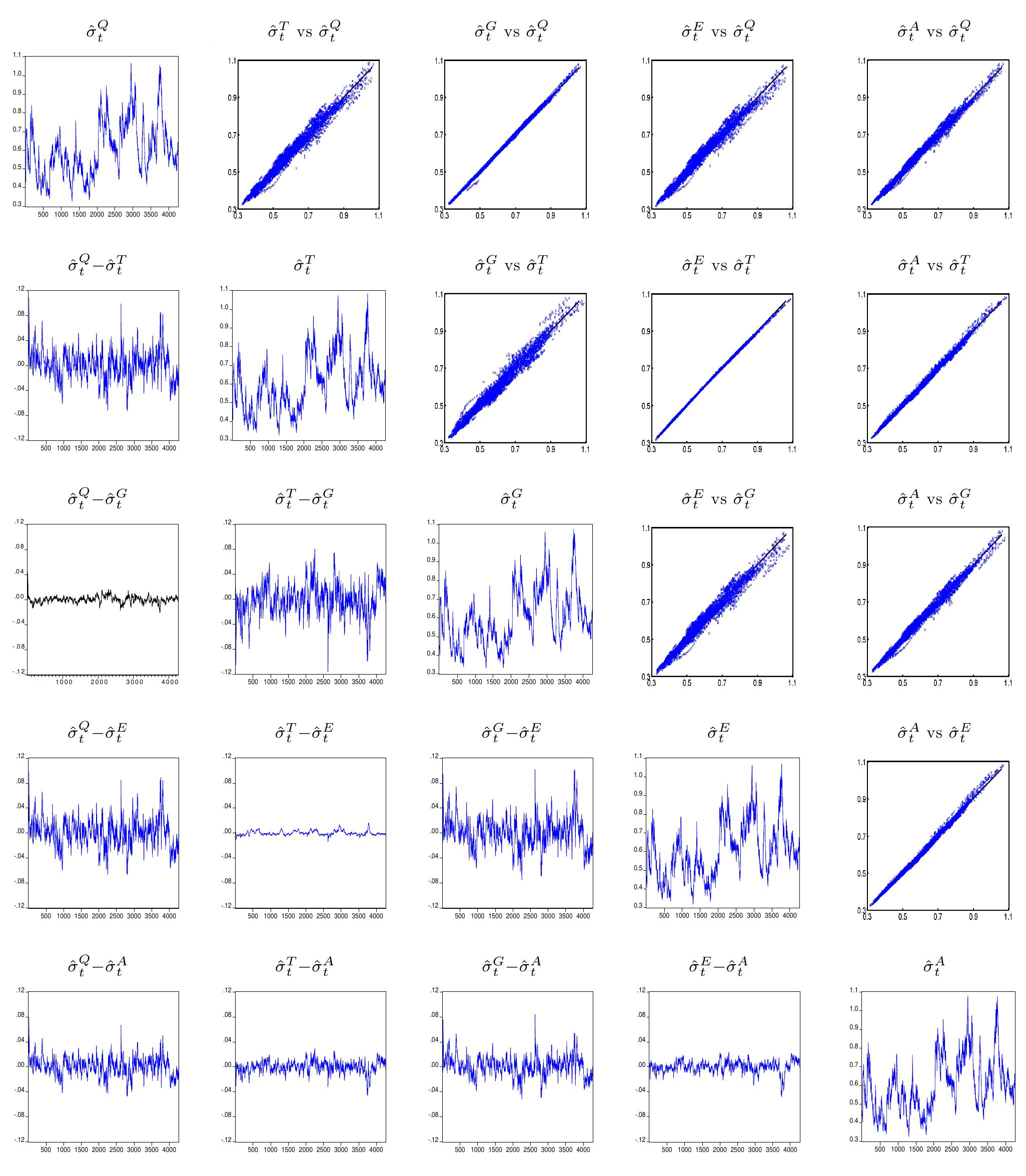

A multivariate positive definite estimator of the integrated covariance matrix of noisy and asynchronously observed asset returns is proposed. We adopt a Bayesian Dynamic Linear Model where microstructure noise is interpreted as... more

This paper is the first attempt to assess the impact of official FOREX interventions of the three major central banks in terms of the dynamics of the currency components of the major exchange rates (EUR/USD and YEN/USD) over the period... more

Ketimpangan upah merupakan isu global yang terus berkembang, mencakup perbedaan upah antar tempat kerja meskipun pekerja memiliki kualifikasi yang serupa. Sistem upah konvensional yang berfokus pada efisiensi ekonomi cenderung mengabaikan... more

Predicting the future accurately is of vital importance in all disciplines, as well as in the field of social sciences. Especially today, due to the development of technology and the presence of package programs that can process huge... more

This paper investigates, both in finite samples and asymptotically, statistical inference on predictive regressions where time series are generated by present value models of stock prices. We show that regression-based tests, including... more

Research on the driving role of digital finance in urban innovation is scarce. Most existing literature focuses on whether digital or traditional finance contributes more to innovation, ignoring the spatial spillover effect of digital... more

This paper examines the intertemporal relation between expected return and risk for 30 stocks in the Dow Jones Industrial Average. The mean-reverting dynamic conditional correlation model of Engle ( ) is used to estimate a stock's... more

The purpose of Education should be gauged in its ability to inculcate morals, value system and skill set among the learners so as to make them an asset for the nation. Human Capital formation is going to play a very important role in... more

has adversely affected all the nations and all the sectors of all nations. However, the effect of the same on all the sectors of the economy need not be uniform. Moreover, the severity of impact need not be the same across consequent... more

El enfoque metodologico que se sigue en este trabajo para estudiar el co-movimiento de los cinco principales mercados de capital europeos es el de Copula-GARCH, ajustando primero modelos GARCH para estimar las distribuciones marginales de... more

The aims of this study were threefold: 1) study the research gap in carpark and price index via big data and natural language processing, 2) examine the research gap of carpark indices, and 3) construct carpark price indices via repeat... more

This study attempted to investigate the effectiveness of the interest rate channel in the transmission of monetary policy by employing a structural vector autoregressive (SVAR) model using sign restriction. It used a set of policy and... more

The series "Studies in Systems, Decision and Control" (SSDC) covers both new developments and advances, as well as the state of the art, in the various areas of broadly perceived systems, decision making and control-quickly, up to date... more

We define the extreme values of any random sample of size n from a distribution function F as the observations exceeding a threshold and following a type of generalized Pareto distribution (GPD) involving the tail index of F. The... more

Sovereign wealth funds (SWFs) have over $11.5 trillion in assets under management as of February 2023. Most of these 176 funds are sponsored by non-Western countries and their growth has made SWFs important international investors,... more

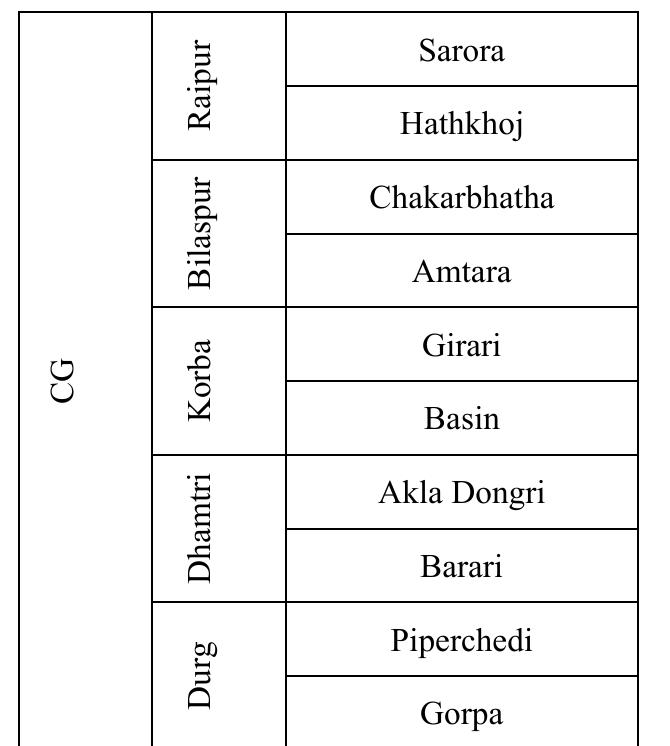

The sustainable growth requires a holistic approach, where all members of the society grow equally. This study compares two states—Madhya Pradesh and Chhattisgarh in an effort to analyze financial inclusion, including the use of banking... more

This study investigates financial markets’ volatility and verifies the model that is suitable in BRICS stocks (2003-2018). The data were gotten from Yahoo finance. For the methodology, the ADF was applied to test stationary of the BRICS... more

In this paper, we compare the statistical properties of some of the most popular GARCH models with leverage e¤ect when their parameters satisfy the positivity, stationarity and nite fourth order moment restrictions. We show that the... more

Financial support from projects BEC2002 03720 by the Spanish government and IHP RNT 00 2 by the European Community is acknowledged. This research was started while Ana P erez was visiting the

proposes the FIFGARCH model to represent long memory asymmetric conditional variance. Although he claims that this model nests many previous models, we show that it does not and that the model is badly specified. We propose and... more

This paper studies the predictive power of several financial variables usually used as proxies for global liquidity, volatility, and risk aversion in forecasting exchange rates for a set of countries from January 2001 to April 2013. The... more

Purpose-The purpose of this study is to analyze the effects on economic growth of export in the leading countries ICT exports. In this context, the relationship between information communication technology exports and economic growth of 7... more

This paper examines the interactions among CDS spreads across 13 European countries using spatial econometrics techniques. Our model allows for the estimation of direct and indirect transmission of sovereign risk and feedback effects... more

The Indian stock market is one of the most dynamic and promising in emerging markets. Domestic institutional investors (DIIs) and foreign institutional investors (FIIs) are the two major players in the Indian capital market. Foreign... more

The authors illustrate how a firm can face the challenge of forecasting consumer reaction for a really-new product. For the case of an electric vehicle, the authors describe how one firm combines managerial judgment and stateof-the-art... more

In this paper stock market development as proxied by market capitalisation is examined. The study period is January 2010 to May 2019. The data frequency is monthly. The paper concentrates on the Zimbabwe Stock Market, but briefly walks... more

This paper applies the mildly explosive/multiple bubbles testing methodology developed by Phillips, Shi and Yu (2013, Cowles Foundation Discussion Paper Nos. 1914 and 1915) to examine the recent time series behaviour of London Metal... more

By Newton CA da Costa, Emilio A. Menezes and Eduardo Facó Lemgruber; Estimação do beta de ações através do método dos coeficientes agregados.

In the second chapter 2, Gökçe and Kızılkaya discuss unemployment hysteresis in selected OECD countries. According to results of panel stationary test, the hypothesis of unemployment hysteria is invalid for the panel. In addition, when... more

We establish the strong consistency and the asymptotic normality of the variance-targeting estimator (VTE) of the parameters of the multivariate CCC-GARCH(p, q) processes. This method alleviates the numerical difficulties encountered in... more

College Dublin for helpful comments. We thank Honghao Wang for excellent research assistance. Connor acknowledges the support of Science Foundation Ireland under Grant Number 16/SPP/3347.

Este paper muestra el pronóstico de la tasa de cambio entre el peso colombiano y el dólar estadounidense (en adelante dólar) desde Diciembre del 2019 hasta Diciembre del 2020, basado en un modelo VEC (Vector Error Correction) a partir de... more